ANSONIA – Ansonia’s proposed budget fully funds the board of education’s request for the coming year – but the budget as-is would require voter approval because of the increase in the mill rate.

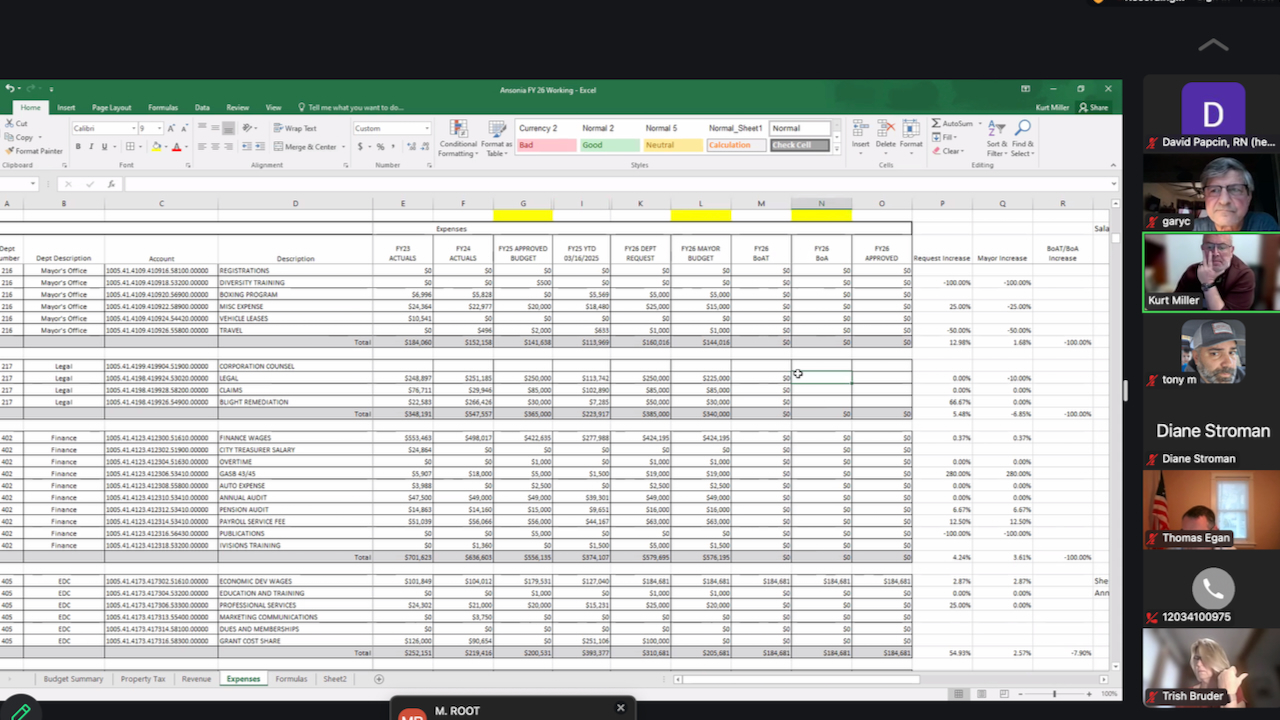

The Ansonia tax board and the Aldermanic finance subcommittee met Wednesday (March 19) to discuss the city’s $69,593,839 proposed budget for the coming year.

The proposed budget has increased by about $1 million from the $68.6 million budget Mayor David Cassetti proposed in February.

The proposed budget doesn’t include a mill rate.

However, Cassetti’s earlier proposed budget included a tax increase of 2.61 mills, an increase of 9.85 percent compared to last year.

Any tax increase over three percent requires voter approval via referendum, due to a 2015 charter change written by Cassetti’s administration.

That referendum would happen after the full Board of Aldermen approves a budget. Budget director Kurt Miller said a referendum could happen toward the end of April.

The referendum would contain two questions, requiring voters to either accept or reject both the city’s spending and the school board’s spending.

Cassetti’s proposed mill rate was 29.1 mills. The current mill rate is 26.49 mills.

Under Cassetti’s budget, a single-family home on Holbrook Street assessed at $180,000 would pay $469.80 more per year in taxes.

A house on Gardners Lane assessed at $248,000 would pay $647.28 more per year.

A house on High Acres Road assessed at $366,000 would pay $955.26 more per year.

Spending Breakdown

The proposed budget is a 3.74 percent spending increase compared to the current budget. It includes $39,560,719 for the board of education and $30,033,120 for the city.

City-side spending would increase by 1.79 percent under the new budget, while board of education spending would increase by 5.28 percent. Click here for a story about the board of education’s budget.

Spending increases on the city’s side include:

$536,475, or an 8.74 percent increase for city employee benefits (including health insurance and retirement);

$233,215, or a 3.63 percent increase for the police department;

$104,383, or a 3.26 percent increase for city administration costs, and

$104,105, or a 16.15 percent increase for building maintenance, upkeep, and repairs.

Budget director Kurt Miller said expenses have gone up since February because the board of education requested more money. The board of education voted March 12 to request $39.6 million from the city. The city’s proposed budget currently meets that request.

Most of the education spending increase is tied to student transportation cost increases, which school board members say place an unfair burden on cities without sufficient state support. Click here for a story.

In a December report, bond rating agency S&P Global criticized the city’s use of its fund balance to meet expenses. It threatened to downgrade the city’s bond rating if it doesn’t reduce its reliance on the fund balance.

Budget Includes ‘Use Of Future Revenue’

Miller didn’t talk about the city’s revenue lines in the meeting. He said they’d be a topic at the next meeting, which is scheduled for Monday (March 24).

However, the revenue sheet in the proposed budget includes $5,250,000 in ‘use of future revenue.’ It also includes $205,000 under a separate line item titled ‘fund balance as income.’

Bond rating agency S&P Global released a report in December criticizing the administration for its reliance on using its fund balance to fund operations. It threatened to downgrade the city’s bond rating if it doesn’t reduce that reliance.

If passed, this would be the city’s third budget in a row that includes future income as revenue. Last year, the city budgeted about $7.4 million in ‘use of future revenue,’ and $5 million the year before that.

If the budget were passed as-is, that would be a total of about $17.7 million the city has budgeted for ‘future revenue.’

City Democrats have criticized the administration for the accounting practice, referring last year to future revenue as “ghost money.” Members of Cassetti’s administration say the practice allows them to ease taxpayer burdens by banking on development projects that are in the works.

The Valley Indy interviewed Miller about the practice last year.

The revenue sheet on the proposed budget says that the city ended up using $7,318,888 in ‘future revenue’ last year, and $3,109,601 the year before that.

Next Meeting Dates

The tax board technically already approved a budget March 3. However, they are continuing to hold meetings with the Aldermanic finance subcommittee to adjust it before sending it to the full Board of Aldermen.

The next public meeting is scheduled for March 24 via Zoom. To access the meeting, go to the city website, click the ‘Meetings’ tab, and click the link for the meeting you want to attend.

On March 31, another meeting is scheduled, where Miller said board of education officials will present their budget request to the tax board and finance subcommittee.

The last of the currently scheduled public meetings is April 8. The subcommittee could vote to forward the budget to the full Board of Aldermen on that date.

After the full Board of Aldermen approve a budget, it will likely head to voter referendum in late April. Ansonia Corporation Counsel John Marini stated at a previous meeting that the city is trying to stick to a schedule that would allow up to three referendums, if needed.