DERBY — City government is currently looking at a budget that would increase spending by roughly $2 million during the fiscal year starting July 1.

The mill rate, as it stands under a draft budget being reviewed by the Derby Board of Apportionment and Taxation, would decrease if the budget was adopted as-is today.

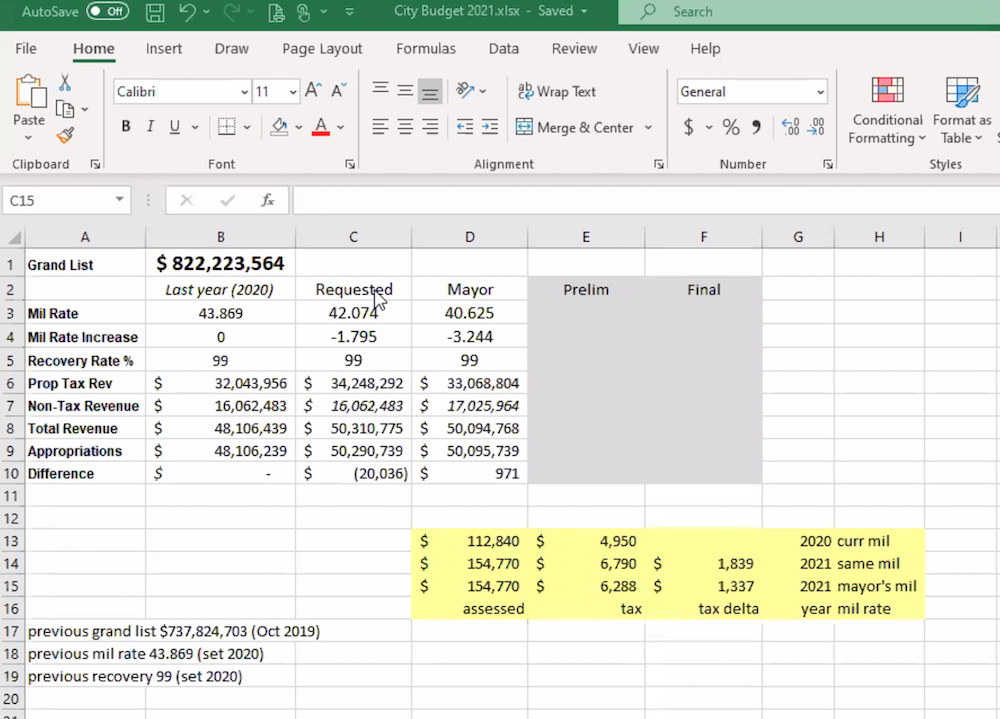

The mill rate in Derby today is 43.869.

During Tuesday’s tax board meeting, the board was looking at lowering the mill rate to 42.

However, a lower mill rate does not necessarily mean lower property tax bills. The city is in a state-mandated revaluation year, which complicates the local budget formation process.

Judy Szewczyk, the tax board’s chairwoman, noted some single-family houses in Derby are seeing 17 percent increases in assessments, at least. Multi-family home owners are seeing assessment increases of 26 percent, at least. Commercial property owners are seeing assessments fall by 5 percent, Szewczyk said.

Those are averages, Szewczyk pointed out. The percentages are all over the place, which means residents have to take the time to do math to see what their tax bills will actually look like.

Here’s how:

1. Find your old tax bill and look at how much you paid

2. Find your new assessment, which is available online here

3. Multiply your new assessment by 42, then divide that answer by 1,000. That’s your new property tax bill.

4. Compare your answer to your last tax bill.

BUT KEEP IN MIND DERBY HAS NOT ADOPTED A MILL RATE YET, and the city is not scheduled to do so until mid-April.

So the numbers — specifically that mill rate — are under discussion and could change.

In fact, during Tuesday’s meeting, Derby Mayor Richard Dziekan introduced a proposed budget about $195,000 less than what the tax board is considering. His mill rate came in at 40.6 mills.

The mayor presesnted a budget this year because voters in November approved a charter change requiring him to present a budget.

The mayor’s budget totaled about $50 million, while the tax board’s budget totaled $50.2 million.

The budget adopted last year totaled $48.1 million.

Tax board members, including Brian Coppolo, expressed an interest in lowering the mill rate further, hoping to get it down to the 39 mark or so. On the bright side, the city is expecting to see an influx of state and federal dollars this year in the form of COVID-19 economic recovery funds.

The city’s grand list, by the way, currently stands at $822,223,564, according to data shared at Tuesday’s tax board meeting. That’s an increase of $84.3 million.

An important step in the annual budget process will happen Tuesday, March 9, when Derby school officials present their education budget to the tax board. Check the Derby city calendar for more information on that meeting, including Zoom info needed to join the meeting.

According to Derby Public Schools Superintendent Matthew Conwway, Derby schools are requesting $19,706,006 from the city — a 3.3 percent, or $628,299, increase over the current school budget.

“This school system has been extremely frugal and has lived with a three year average increase funding level of 1.2 percent, which is amazingly low compared to our area school systems and anywhere in the state,” said Jim Gildea, chairman of the Derby Board of Education. “We have consistently and aggressively found ways to get our special education costs under control, be extremely lean in the administrative costs that come out of our operating budget and aggressively pursue grants to assist with the teaching of our students. With that as a backdrop, the funds we are requesting are incredibly reasonable and responsible.”

In Derby, the tax board approves a budget and sets the mill rate each year.