If you are late paying local property taxes, state law says you must be hit with interest penalties.

If you are late paying local property taxes, state law says you must be hit with interest penalties.

But that did not happen in Ansonia for at least 100 taxpayers in fiscal year 2011.

And now the city’s corporation counsel is recommending a special audit to determine whether the city lost out on even more money.

The new information comes from a memo given to former Mayor James Della Volpe in 2012 by Stanley J. Gorzelany, the man hired by Della Volpe to address problems in the tax office brought on by the sudden departure of Bridget Bostic, the city’s previous tax collector.

The memo was not shared with the public, nor was it included in internal city documents given to Mayor David Cassetti’s administration during the transfer of power in 2013, according to John Marini, Ansonia’s corporation counsel.

What prompted the memo to see the light of day?

Gorzelany said he read a story by the Valley Indy Oct. 13 which shed new light on Bostic’s departure.

The new information in the story prompted him to resubmit his 2012 memo to Ansonia’s current mayor.

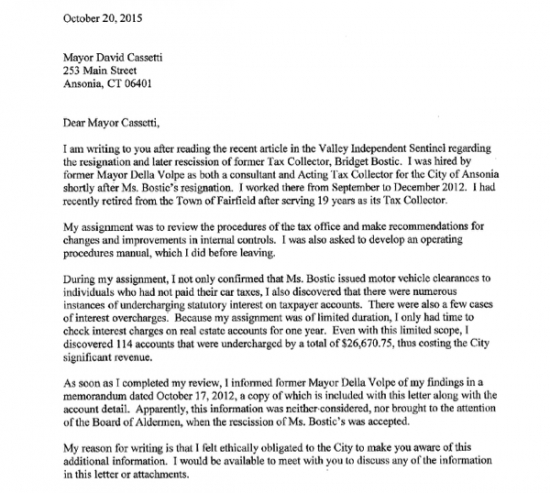

In a letter Oct. 20 to Cassetti, Gorzelany said Ansonia lost “significant revenue” on property taxes in the single year he reviewed.

Gorzelany found the city failed to collect $26,670.75 in interest on late taxes between July 2011 and June 2012.

According to Gorzelany’s memo, the tax office, under former tax collector Bostic’s watch, used an override code in computer software to change the amount of interest payment due.

In some cases, the override code was used with an appropriate explanation. There are circumstances when a tax collector has to manually adjust the amount due, such as when a taxpayer’s check bounces or partial payments are being made by a person’s lawyer.

But in many cases, the tax office used the code to reduce interest owed on a late payment, or to simply erase all interest charges owed on a late payment. No explanations were recorded.

That’s not supposed to happen.

State law requires tax collectors to add interest to late tax payments. Tax collectors have no authority under state law to reduce the interest penalty or erase it.

Gorzelany’s letter is below.

Background

Bostic resigned after a 2012 Valley Indy story reported she was handing out receipts to people showing they had paid their motor vehicle taxes when, in fact, they had not paid.

The receipts allowed the people to continue registering their vehicles with the state Department of Motor Vehicles even though they owed about $16,000 locally.

Ansonia government started its own investigation and confirmed the Valley Indy reporting.

The city’s “fact finding” report was turned over to a state prosecutor for review. No charges emerged.

It’s not known whether Gorzelany’s findings were given to the prosecutor.

Click here to read every Valley Indy story on the issue.

The Consultant’s Findings

Gorzelany was hired by Della Volpe in the fall of 2012 as a consultant and interim tax collector following Bostic’s departure.

He worked in Ansonia from September 2012 to December 2012, after retiring as the Town of Fairfield’s tax collector, a position he held for 19 years.

In the wake of Bostic’s departure, he reviewed the procedures in the Ansonia tax office and made suggestions for improvements. He wrote a procedure manual for the office, which is now followed.

In the wake of Bostic’s departure, he reviewed the procedures in the Ansonia tax office and made suggestions for improvements. He wrote a procedure manual for the office, which is now followed.

His recommendations were unanimously accepted by the Board of Aldermen and he was publicly thanked for his work.

Gorzelany also reviewed a year’s worth of property tax transactions during his short stint in Ansonia.

He found the override code was used by the tax collector’s office 212 times out of about 12,000 property tax transactions.

Of the 212 overrides, about 100 transactions did not provide an explanation as to why staff changed the amount of interest due.

Of those 100 transactions, Gorzelany identified about 13 taxpayers who received especially deep discounts on interest due.

A cursory review of those approximate 13 names Friday by the Valley Indy show they included at least one employee of the city’s water pollution control authority, a person who worked for the school district at some point, a local business owner and a limited liability company based on Franklin Street.

The 2012 Valley Indy car tax story showed a pattern among people who were receiving car tax “clearances.” The recipients included city workers and Bostic’s mom.

Regarding the failure to charge interest on late property taxes — it wasn’t Gorzelany’s job to look into who the taxpayers were or whether they were connected to Bostic or tax office staff or to the city in some way.

He gave a list of more than 100 taxpayers not charged full interest on late payments to former Mayor Della Volpe. Mayor Cassetti received the information Friday.

The overrides raise obvious questions of fairness. Thousands of people paid their taxes on time during the period reviewed by Gorzelany. Others paid late and were hit with interest penalties, as dictated by state law.

“ … failure to follow state statutes for charging interest resulted in significant loss of revenue to the City of Ansonia for the period reviewed,” Gorzelany wrote.

Reaction

There is a municipal election in Ansonia Nov. 3.

Gorzelany said he has no connection to Ansonia politics.

In his Oct. 20 letter to Cassetti, he said he read a story in the Valley Indy Oct. 13 and felt compelled to share his old memo again.

“My reason for writing is that I felt ethically obligated to the City to make you aware of this additional information,” Gorzelany wrote in the letter.

In an interview with the Valley Indy Friday, Gorzelany noted the taxpayers who received questionable car tax clearances eventually paid their car taxes — with interest. But the failure to charge interest on late property taxes truly cost the city revenue.

John Marini, the city’s corporation counsel and a former Republican Aldermen, said no members of his party were aware of the Gorzelany tax interest memo until the information arrived in Ansonia City Hall Friday (Oct. 23).

He said the memo was not included in documents turned over by the Della Volpe administration after David Cassetti won the mayor’s office in 2013.

Marini gave the Valley Indy a copy of Gorzelany’s letter and memo Friday morning.

“It’s disturbing. This is taxpayer money and Ms. Bostic may have broken the law, according to the information from Mr. Gorzelany,” Marini said.

The corporation counsel said the information should have been shared with the Board of Aldermen in 2012 so they could have investigated the matter further.

Marini noted Gorzelany found at least 100 questionable transactions in a single fiscal year.

A wide-ranging review is needed, Marini said.

Marini said he will recommend the Aldermen hire an outside firm to conduct an audit. The review should be expanded to cover more years, and to cover motor vehicles and other taxes as well, Marini said.

Marini said he hasn’t identified any kind of pattern among the hundreds of people who allegedly received breaks on their late payments.

“It would have been helpful to have this information in 2012, when we could have asked Ms. Bostic. Now it’s two years later and the trail is cold,” Marini said.

The Valley Indy shared Gorzelany’s letter and 2012 memo with Edward Adamowski, a Democrat on the Board of Aldermen who served under Della Volpe, also a Democrat.

Adamowski is hoping to unseat first-term Republican Mayor David Cassetti Nov. 3.

Adamowski said he was angered to hear the city missed revenue, but said the past problems in the tax office have no bearing on the current mayor’s race.

“If what is in that letter is true, of course it should have been shared with the Aldermen,” Adamowski said.

Like Marini, Adamowski wasn’t aware of the information in the 2012 memo to Della Volpe. Adamowski said he wants answers as well.

“If Mayor Della Volpe didn’t tell us, or if Mayor Della Volpe did something wrong, that’s on Mayor Della Volpe,” Adamowski said.

Della Volpe has not responded to messages left on his cell phone, but he told The New Haven Register he took appropriate action regarding Bostic’s departure.

When Bostic’s car tax problems first emerged in 2012, the Aldermen were united, Adamowski said. Everyone wanted answers, regardless of political affiliation.

“We all brought up the same points. We all wanted to know what happened. All the Aldermen were all on the same page at that point,” he said.

Marini said the issue shows the previous Democratic administration had a transparency problem. Adamowksi said it’s not fair to connect him to that problem, since all Aldermen were in the dark.

“I’m not James Della Volpe. I’m not David Cassetti. I’m Ed Adamowski,” he said.

Tara Kolakowski, the chief of staff and acting personnel director under Della Volpe, said in an email Friday she had no knowledge of the taxpayer list referenced by Gorzelany in his letter.

Cassetti wasn’t available for comment Friday afternoon.