PHOTO: Jodie Mozdzer Gil First Selectman Kurt Miller, left, and Board of Education Chairman Yashu Putorti, right, after the budget vote Thursday.

Budgets in Seymour are usually rejected on the first scheduled town-wide vote.

The combined $56.1 million budget for 2016 – 2017 will mean a tax rate of 36 mills next year, an increase over the current 34.59 mills.

But the amount residents will pay in taxes really depends on what happened to their property values during the most recent revaluation.

“This is really, really thrilling,” said Board of Education Chairman Yashu Putorti after the results were announced at the Seymour Community Center on Pine Street.

The Board of Education budget has been rejected by voters during initial budget votes in the past, and Putorti said when he saw the low turnout, he was worried the same thing might happen again this year.

“Low turnout usually means it doesn’t pass,” Putorti said.

Of 9,614 registered voters in Seymour, only 780 people voted Thursday.

The results for the town budget were: 438 for, and 340 opposed.

The results for the school budget were 431 for and 349 opposed.

PHOTO: Jodie Mozdzer Gil Yashu Putorti: “I'm ecstatic.”

First Selectman Kurt Miller credited the one-vote passage to the “comfort level” residents have with the fiscal health of the town.

“I think people appreciate the fact that we are doing a tremendous amount of long-term planning,” Miller said.

Taxes

The real estate tax rate will be 36 mills in 2016 – 2017. That means a homeowner with a property assessed at $150,000 would pay $5,400 in taxes next year.

While the tax rate is higher than the current rate of 34.59 mills, the change in taxes owed will depend on how each property was appraised in the town’s revaluation this past year.

“Even with the mill rate increase, the revaluation will result in lower property taxes for most Seymour residents,” Sawicki wrote in his letter to voters included in the town’s budget packet.

While the town assessor didn’t have a breakdown of how many homes decreased in value, the overall grand list decreased by $38 million after the revaluation, according to Sawicki’s letter.

Spending

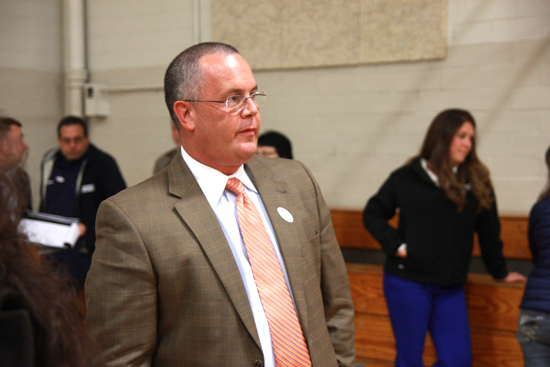

PHOTO: Jodie Mozdzer Gil Kurt Miller, before the results were announced May 5.

The approved town budget, at $23.5 million, includes $17.8 million in town spending, $4.9 million in debt service costs, and money toward capital projects and the contingency fund.

The approved education budget is $32.6 million.

The Board of Education budget represents an increase of $18,968 — or 0.06 percent — over current spending. That was achieved through five early and one additional retirement, a reduction of five teaching positions, and a negotiation with health insurance company Anthem to keep rates steady next year, according to a presentation the Board of Education gave to parents in April.

“I’m happy the people of the town looked at the numbers and saw we came in extremely low and voted in favor,” Sawicki said after the vote.

Budget votes

Town officials at the Community Center Thursday didn’t know exactly when the last time the town and school budgets passed on the first go-around, but it hasn’t happened since before 2010, according to Valley Indy articles on the budget.

One year, voters even rejected a zero-percent increase budget proposal for the Board of Education.

In 2010, the town budget passed on the third vote, and the school budget passed on the fourth vote.

In 2011, the town budget passed on the second vote, and the school budget passed on the third vote.

In 2012, the town budget passed on the third vote, and the school budget passed on the fourth vote.

In 2013, the town budget passed on the second vote, and the school budget passed on the third vote.

In 2014, both budgets passed on the second vote.

Last year the town budget passed on the first referendum, and the school budget passed on the second referendum.