It is imperative that the residents of the City of Ansonia receive accurate and reliable grand list information from the grand list located in the Assessor’s office, in lieu of grand list estimates from Democratic Town Committee.

It is imperative that the residents of the City of Ansonia receive accurate and reliable grand list information from the grand list located in the Assessor’s office, in lieu of grand list estimates from Democratic Town Committee.

Unfortunately, the information submitted from the Democratic Town Committee appears to be self-serving and contains speculative projections without a solid basis, which is frankly irresponsible.

Let’s start with the state of the City’s grand list prior to the current Mayor and administration.

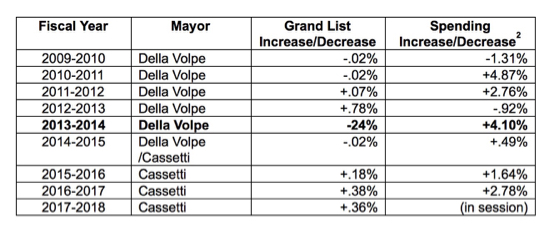

In 2012, under a Democratic administration the grand list decreased twenty-four percent (24%), creating an 11.69 mill increase. Therefore, a property assessed at $100,000 had a tax increase of $1,169.00. And the average motor vehicle tax for a vehicle assessed at $10,000 was an additional tax of $116.90. The Democratic administration followed up with another .02% decrease on October 1, 2013.

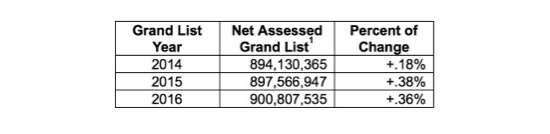

Upon the installation of a new Republican administration the grand list has been consistently increasing. Below are the grand list figures and percentages of change since 2013.

One clear error on the chart provided by the Democratic Town Committee is the ‘Actual 2017 Grand List’ in the amount of $870,635,574. 1. The 2017 grand list will not be determined until October 1, 2017, following the revaluation. 2. The 2016 grand list (which is collected in 2017) was actually $900,807,535.

One item that adversely affects the overall grand list are the burdens placed upon municipalities due to unfunded state programs/exemptions and ultimately fall upon the residents, in one form or another. Unfortunately, the Mayor has no control over this nor its effects.

Presently, current sales within the City of Ansonia, indicate the revaluation will bring an increase to the real estate grand list.

The personal property and motor vehicle grand lists are determined by bringing in new business and scrutinizing the motor vehicle list as well as assessing non-registered and out-of-state registered vehicles that are garaged in Ansonia.

Since the change in political office, the business personal property has increased an average of .91% and motor vehicles have increased an average of 1.96%.

Another historical fact regarding spending increases between Democratic and Republican administrations:

Based on the above information, the Democratic administration averages a 1.9% increase spending and the Republican administration averages a 1.64% increase spending. However, it is quite disturbing that in the year with the highest tax increase (grand list decrease), there was a 4.10% spending increase by the Democratic administration.

The Assessor’s office has been on a continuous mission to pick up the pieces of an injured grand list from the prior Democratic administration. The need to be more accountable, proactive, diligent, aware, fair & equitable, and available to the public is essential.

The current administration has been working tirelessly on bringing in new business, cutting department budgets, improving relations with business owners and residents, being more involved in the City of Ansonia and striving to make it better, every day. It is the unwavering dedication of this administration rebuilding and reinforcing our hometown pride in the City of Ansonia.

Therefore, it is wise and prudent to make sure you are well informed and validate information distributed by others. Grand list books and approved budgets are public and available for inspection.

Views expressed in guest columns and press releases do not necessarily reflect the views of ValleyIndy.org. The Valley Indy has a 550-word limit on guest columns.